Embrace your local Opportunity Zones

Many urbanists have skepticism—even cynicism— about Opportunity Zones (OZs). This new federal initiative that was part of the 2017 tax law is still gearing up, but most agree that it will have a big impact on cities. “Given the significant interest among investors, it is possible that this new incentive could attract hundreds of billions of dollars in private capital, making it one of the largest economic development initiatives in US history,” says Bruce Katz, a longtime Brookings Institution scholar who now consults on metropolitan policy.

As Strong Towns founder Charles Marohn recently remarked, colorfully, on Facebook: “I'd love to imagine this capital flowing to a lot of incremental developers doing four-plexes in struggling neighborhoods, but I think it more likely that a REIT-like-entity will take the profits from a bunch of yacht rentals and funnel that for people into buy a couple square blocks and building a monoculture of apartment buildings.”

On the other hand, OZs are different from previous large-scale federal economic development programs in many respects—and urbanists should pay close attention to such distinctions before dismissing this program. First, here’s a basic description: There are 8,700 OZs designated in every state and most cities. They target low-to-moderate-income urban and rural areas—or census tracts adjacent to those areas. The federal government provides substantial tax relief on capital gains to investors who transfer gains into an Opportunity Zone fund, one that invests primarily in OZs. The clock is ticking for investments, and the latest gains subject to tax deferral will come at the end of 2026.

So what makes OZs different? As Jared Bernstein, form chief economist to Vice President Joe Biden, wrote recently in The Washington Post: “It is not for nothing that James Baldwin relabeled the 1960s urban renewal as ‘Negro removal.’ But unlike the federal projects of that era, OZs and their investment funds have zero power to override local rules.” That’s a critical point: If poorly planned development occurs in an opportunity zone—such as a “monoculture of apartment buildings,” or strip malls with massive parking lots in front—that’s because the local rules and plans allow and/or encourage such development to take place. It’s not because the feds are sweeping in with bulldozers.

The corollary is that municipalities have substantial power to direct the OZ funding to maximize its potential for good, if they take the initiative. As Katz writes in a report coauthored with Evan Weiss: “Cities can use public resources to steer market investment, particularly towards historically disadvantaged areas. Cities should ensure that every Opportunity Zone is included in a citywide inclusive zoning, procurement, and development policy that focuses on residents and require data transparency for deals that receive public subsidy. … Cities can go further and drive inclusive growth through supporting minority owned businesses, homeownership, affordable housing and neighborhood amenities.”

A second major distinction of OZs is that investments from this program scale up and down without difficulty. In contrast to programs like LIHTC (Low-Income Housing Tax Credits), it is easy for a small developer to clear the bureaucratic hurdles for OZs, according to John Anderson, a founder of the Incremental Development Alliance. “It is not a program with federal, state or local staff—It is a change in the federal tax code,” he says. “A developer who reads the new regulations can figure out if they want to provide their investors with the tax benefit.” All that is required is to file a single IRS form at tax time to create an Opportunity Zone fund for a project, he points out. Investments can come from people with small pools of capital gains—friends and family—or from high-net-worth individuals and households that may have an interest in investing locally.

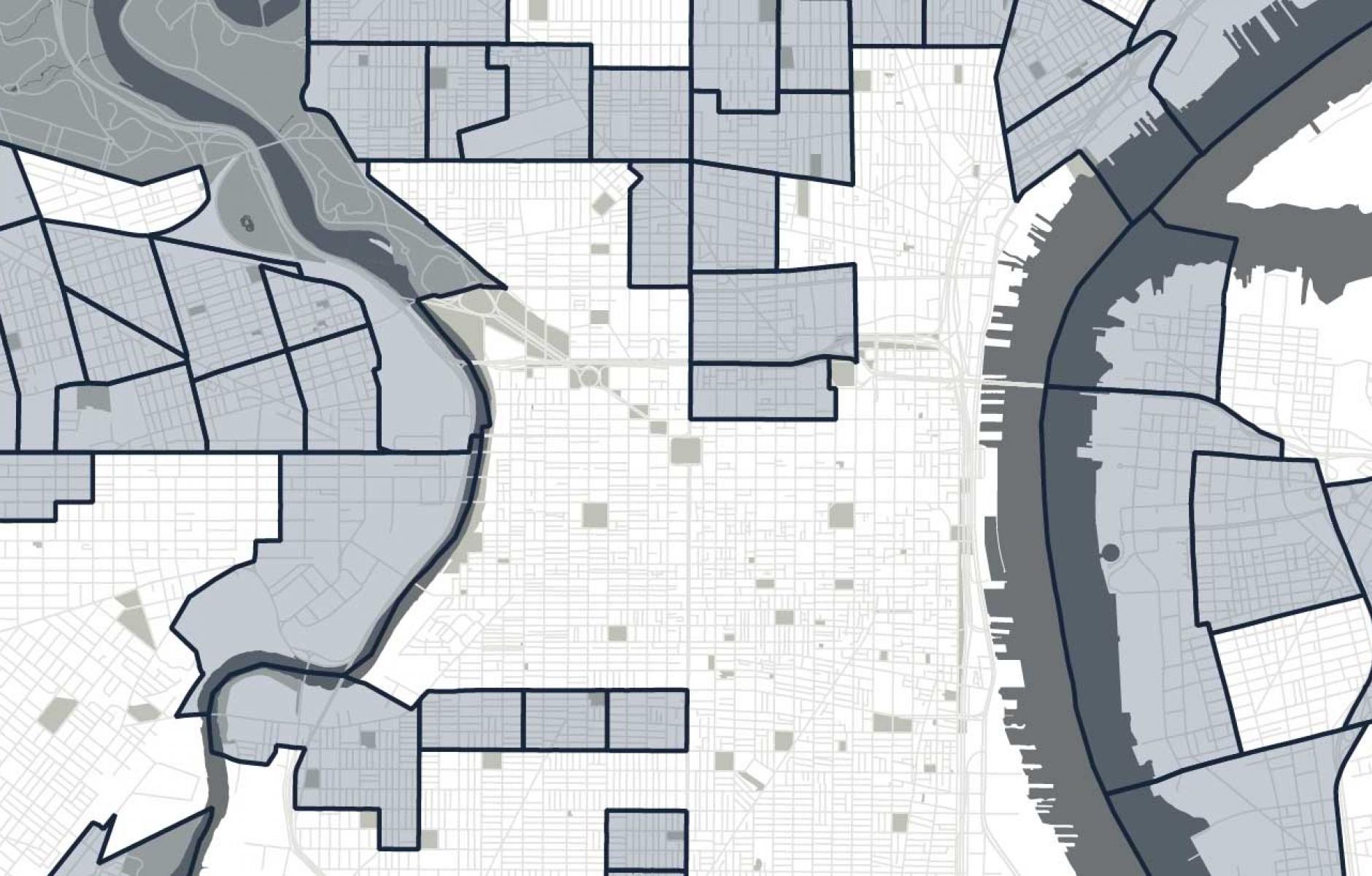

Opportunity Zones present an excellent framework for local capital to be invested in incremental projects by local small operators, says Anderson. They need to become familiar with the rules and with the OZs in their region (here's a nationwide map). “Here’s an exercise for urbanists. Find the boundaries of the census tracts that comprise the opportunity zones in your local area (chances are these will also be census tracts that local and regional banks need to step up their Community Reinvestment Act lending). Now go walk the neighborhood and find a half dozen vacant or underutilized parcels. Figure out what could be built there, given local zoning, likely rents and likely costs.”

Because of the substantial tax breaks, OZs should lower the cost of finance—making some projects viable that weren’t before, Anderson says. “If modest projects in neighborhoods that have seen decades of chronic disinvestment can have private capital that only needs a 5 percent IRR that stays in the project for ten years, I figure that is a good thing.”

Anderson and others are not pollyannaish about the program. It is big and decentralized. To the extent that bad (and good) development of real estate and business occurs, it can also happen with OZs. This development will be focused, far more than typical development, on low-income areas. The best way to maximize the good and minimize the bad is for local leaders to take the initiative, according to Katz and Weiss. “Cities in the broadest sense–local governments, urban institutions, networks, and civic leaders—will need to act decisively if Opportunity Zones are to engender not only a large volume of individual transactions but broader growth that is inclusive, sustainable and truly transformative for each city’s economy.”

Katz and Weiss urge cities to become experts on the market potential of their local OZs. “To reduce friction in the market, cities should be an engaged, reliable source of intelligence about their overall economies and each of their Opportunity Zones. Each city should be able to state definitively what gives disparate Opportunity Zones their market traction and potential.”

This is the municipal version of what Anderson is recommending. Know your Opportunity Zones. Also, have a plan for bringing the best kinds of development into those zones. That plan should pay attention to infrastructure, ensuring that it is “high quality and meets performance and sustainability standards.” Katz and Weiss mention “freight rail, wastewater, and storm water investments,” but I think streets are even more important.

Streets are vital for walkability, and walkability is vital for the economy, environment, health, safety, and livability of OZs and cities in general. Check out my article on Olean, New York, where a smart street investment is revitalizing the downtown of a struggling small city, in what has been designated an OZ.

In cities, OZs are scaled, more or less, at the size of a neighborhood (see map at top). They are physical places and affected by physical infrastructure like streets. In other words, they are right up the alley of new urbanists. Even if you are cynical about how big money will manipulate this program, the reality is that OZs are here and they will impact how cities and towns grow in the next decade and beyond. As Katz, Weiss, Anderson, and many others point out, there is much that urbanists, local officials, and developers big and small can do in response.

New urbanists can make substantial contributions to the success of Opportunity Zones. As Anderson says, they have “the know-how, insight, and capability, needed to build places worth caring about.” Just like municipal officials, new urbanists should get to know the rules of this program and the local Opportunity Zones without delay. That’s the first step in helping municipalities to figure out equitable development opportunities that are, after all, the stated purpose of Opportunity Zones.