An agile approach to multifamily in the pandemic

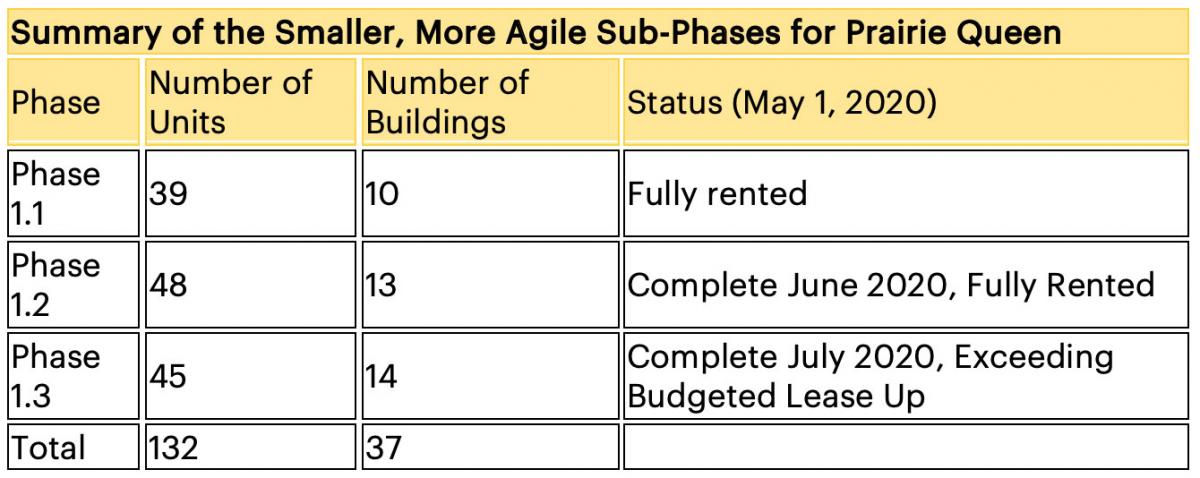

I recently picked up the phone to talk to Gerald S. Reimer, from Urban Waters based in Omaha, Nebraska, about the status of the ongoing construction of the 35-acre Missing Middle Neighborhood we planned for him. Jerry is finishing the last of three sub phases of the multifamily Bungalows On The Lake project, formerly known as Prairie Queen. The three sub-phases have a total of 132 units.

In this two-part blog post, I will cover topics related to this Missing Middle Housing project, including the benefits of tiered financing, tiered occupancy, and reduced construction absorption risk that this approach is providing him.

On our call, Jerry shared some insight with me related to how thrilled and comforted he is in this time of unprecedented COVID-19-related uncertainty with the agility that the Missing Middle Neighborhood is providing him. This was compared to his previous projects which included a three-building, 193-unit conventional suburban apartment project and a 137-unit four-story wood frame over podium urban infill project in the Omaha Metro. Jerry believes he has built enough Missing Middle product to prove that, at scale, the Missing Middle approach to multifamily can be developed in a cost competitive manner to traditional class A apartments.

Project details

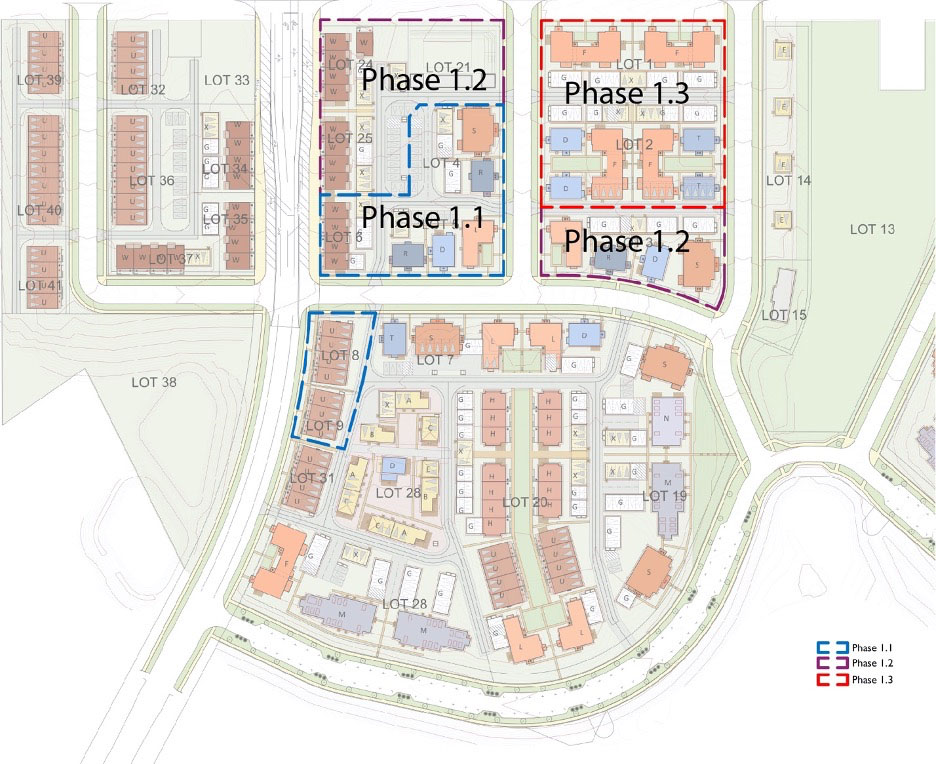

The project is master planned for 742 units on 35 buildable acres within a defined 6 phases. With the Missing Middle approach, Urban Waters is breaking down each of these primary phases into sub-phases of approximately 40-50 units each. The largest building has eight units, and the core of the neighborhood is composed of duplexes, triplexes, fourplexes, fiveplexes, sixplexes, and eightplexes. There are also townhouses and live-work units located on the neighborhood Main Street within the site plan. The project is entirely “for rent” product and every building is 100 percent rentable square footage. There are no shared corridors, no shared stairways. “This is great for self-showings,” says Jerry. All of the apartment buildings are two-and-a-half stories or less and walk ups with no elevators. Rents in Phase 1.1 ranged from $1,000/month for a one-bedroom unit to $3,000/month for townhouses, creating a neighborhood with a range of unit prices and economic diversity.

Agility

The smaller sub phases and smaller buildings are delivering agility, giving Jerry choices to adapt, address market feedback, and anticipate the impacts of COVID-19, reducing his own risk as a developer. “If there was an economic downturn or a ‘shelter-in-place’ order (especially in a market that construction is considered non-essential) in the middle of construction on my last project, 1010 on The Lake, which was a conventional suburban 193-unit apartment project with 90-plus units in one building, it would have been financially devastating, Jerry started off by stating. “This Missing Middle approach designed by Opticos gives me much more agility in various ways that I had assumed prior to embarking on this project, but it’s proving even more true in this time of the pandemic.” Here are a few ways the approach provides this agility:

Multiple tiers of financing

Jerry broke Phase 1, which was 132 units, into three micro-phases. Phase 1.1 has 39 units that are complete and rented, Phases 1.2 has 48 units, and Phase 1.3 has 45 units. Both Phases 1.2 and 1.3 are in various stages of construction and occupancy. The primary reason for this breakdown of phases was to reduce risk by getting separate construction financing for each sub-phase, so there are approximately 40 units per construction loan. Jerry says, “On a typical large multifamily project a developer, such as myself, might take out a $20 million 5 year mini perm loan with three years interest, for which the interest-only term begins on day one. Three years later, the interest-only period expires, while the last building (units) may have been completed after a year two or so.” For Bungalows On The Lake, because he broke down the phase into sub-phases and the building are in 8 unit maximum increments, he can take out three loans that each start at staggered times of the project. The clock for each starts when each phase starts, therefore the interest carry lasts longer.

In addition, this approach of smaller buildings makes it possible to get certificates of occupancy as you go thus achieving positive cash flow quicker than traditional projects. Jerry said this is more of a Japanese mindset he observed, having worked in high level business environment in Japan in the past.

Tiered occupancy

In contrast to waiting to lease a 90+ unit building until after it is fully constructed and has its occupancy permit, Jerry has been able to occupy the buildings for Bungalows On The Lake in 2, 4, and 8 units at a time, as each building is completed. This generates cash flow and enables Jerry to convert his construction financing to permanent non-recourse financing more quickly.

Construction absorption risk

This incremental Missing Middle approach also makes it much easier for Jerry to decide whether or not to continue to build. This approach is particularly helpful in times of economic uncertainty. “Being 80% finished without an occupancy permit on a large 90-unit building generates zero cash flow if construction stops. Having approximately 80% of Bungalows On The Lake completed using the Missing Middle Housing model means I have cash flow on nearly 80% of those units and can use that money to operationalize the project that much quicker,” Jerry states.

Urban Waters/Prairie Queen project is a case study featured in Dan’s book, “Missing Middle Housing: Thinking Big and Building Small to Respond to Today’s Housing Crisis,” which is available here.

This article first appeared on the Opticos Design blog.